Fica Medicare Percentage 2024

Fica Medicare Percentage 2024. This tax allows employees to qualify for part a medicare coverage with no additional cost to obtain coverage through parts b, c, and d. The budget proposes to increase the medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent.

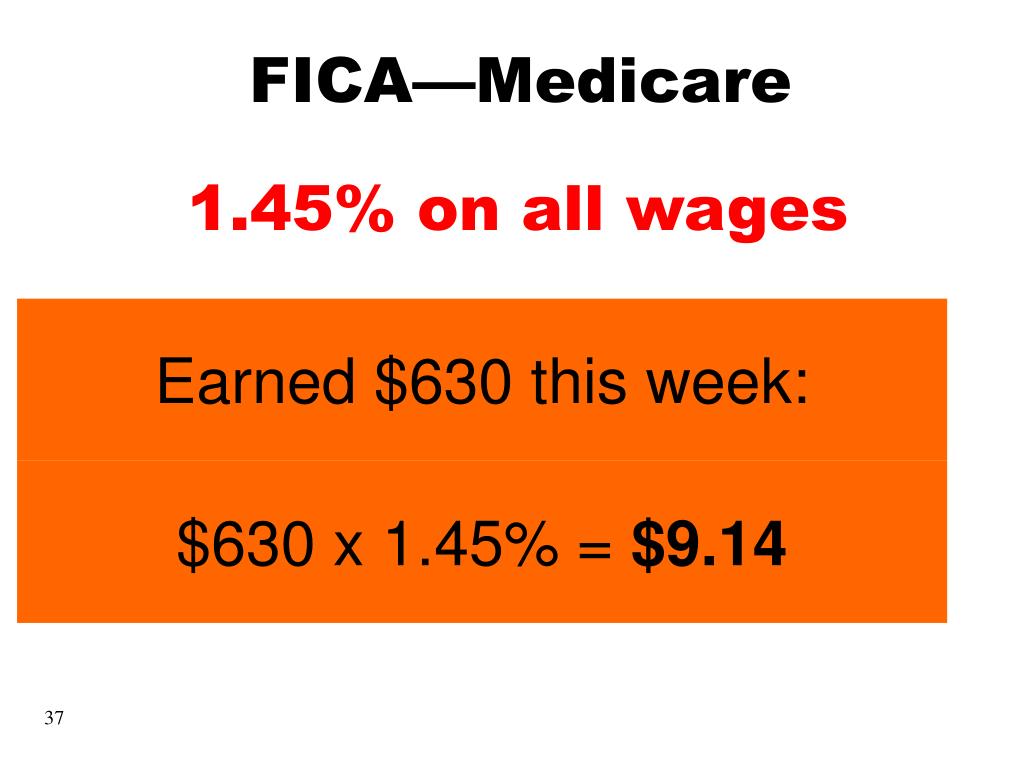

0.9% for the employee when wages exceed $200,000 in a year The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

For 2024, An Employer Must Withhold:

Social security taxes are the 6.2% taken out of your paycheck each month (up to $168,600, the 2024 taxable maximum) while fica refers to the combination of.

The Medicare Tax Funds The Medicare Program, Which Provides Healthcare Benefits To Individuals Aged 65 And Older And Certain Groups Of.

All wages are subject to medicare tax.

The Current Tax Rate For Social Security Is 6.2% For The Employer And 6.2% For The Employee, Or 12.4% Total.

Images References :

Source: www.pinterest.com

Source: www.pinterest.com

Understanding FICA, Social Security, and Medicare Taxes, Medicare tax rate for 2024: 1.45% for the employee plus 1.45% for the employer;

Source: tandiqcarilyn.pages.dev

Source: tandiqcarilyn.pages.dev

How Much Is Medicare In 2024 Tara Zulema, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are Fica And Medicare Deductions, The current rate for medicare is 1.45% for the. With this in mind, understanding.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Cap On Medicare Payroll Taxes, The 2024 medicare tax rate is 2.9% total. As of 2024, employers and employees each pay 6.2% for social.

What is FICA Tax? Intuit TurboTax Blog, Here’s what you need to know. The 2024 medicare tax rate is 2.9% total.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Check Fica Medicare Refund, For 2024, an employer must withhold: The 2024 medicare tax rate is 2.9% total.

Source: medicare-faqs.com

Source: medicare-faqs.com

What Are Fica And Medicare Deductions, As of 2024, employers and employees each pay 6.2% for social. You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is.

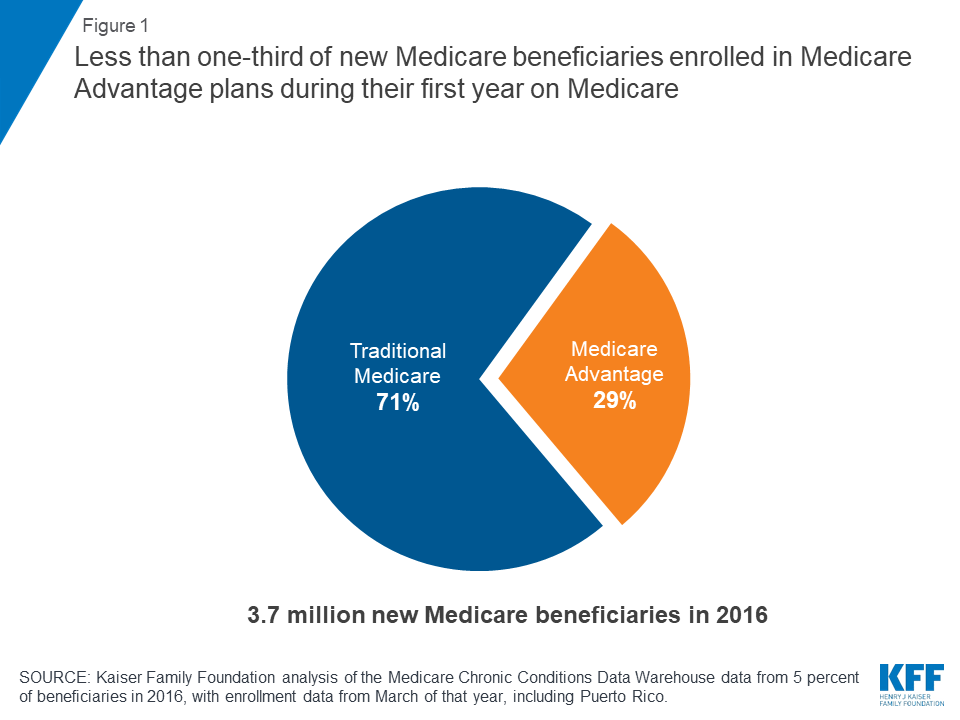

Source: www.kff.org

Source: www.kff.org

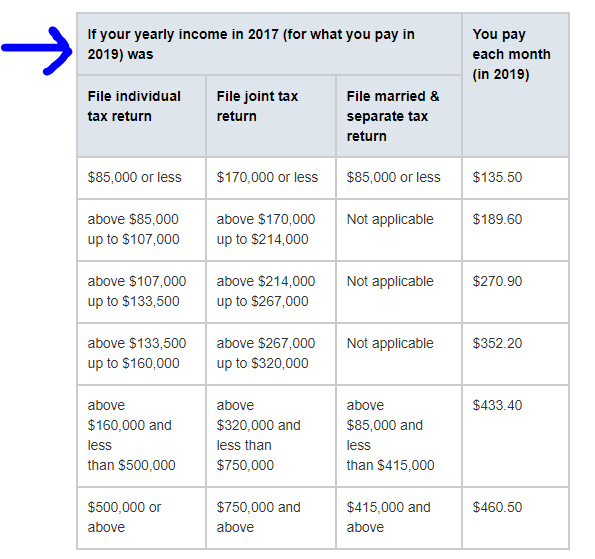

What Percent of New Medicare Beneficiaries Are Enrolling in Medicare, 1.45% for the employer and 1.45% for the employee or 2.9% total. For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Deduct Social Security Tax And Medicare Tax, The second half of fica is the medicare tax. Social security taxes are the 6.2% taken out of your paycheck each month (up to $168,600, the 2024 taxable maximum) while fica refers to the combination of.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Payroll Taxes PowerPoint Presentation, free download ID4318910, This tax allows employees to qualify for part a medicare coverage with no additional cost to obtain coverage through parts b, c, and d. 29 rows tax rates for each social security trust fund.

29 Rows Tax Rates For Each Social Security Trust Fund.

Here’s what you need to know.

The 2024 Medicare Tax Rate Remains At 1.45% For Both Employees And Employers Totaling 2.9%, As It Was In 2023.

The budget proposes to increase the medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent.