Electric Vehicle Depreciation Income Tax

Electric Vehicle Depreciation Income Tax. Do we lodge a nil fbt return for an electric vehicle? Whether a taxpayer can claim the qualified commercial clean vehicle credit in its business depends on who is the owner of the vehicle for federal income tax.

This guide includes rates for tangible and intangible assets,. Do electric cars depreciate faster?

Section 80Eeb Of Income Tax Allows A Deduction On Interest Paid On A Loan Taken For The Purchase Of Evs.

Do we lodge a nil fbt return for an electric vehicle?

1,50,000 Under Section 80Eeb On The.

It will help push faster adoption of evs and generate.

Water Treatment System Includes System For Desalination, Demineralisation And Purification Of Water.

Images References :

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, The 2024 electric vehicle tax credit has been expanded and modified. Conversely, evs typically depreciate by.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, New and unused, co2 emissions are 50g/km or less (or car is electric) 100% first year allowances: Water treatment system includes system for desalination, demineralisation and purification of water.

Source: brookenella.blogspot.com

Source: brookenella.blogspot.com

Irs vehicle depreciation calculator BrookeNella, If you haven't previously entered this credit information for the current asset: New and unused, co2 emissions are 50g/km or less (or car is electric) 100% first year allowances:

Source: howcarspecs.blogspot.com

Source: howcarspecs.blogspot.com

Electric Car Depreciation How Car Specs, This guide includes rates for tangible and intangible assets,. Explore resources and inclusion amounts for electric cars with tax notes.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Explore resources and inclusion amounts for electric cars with tax notes. It will help push faster adoption of evs and generate.

Source: www.thezebra.com

Source: www.thezebra.com

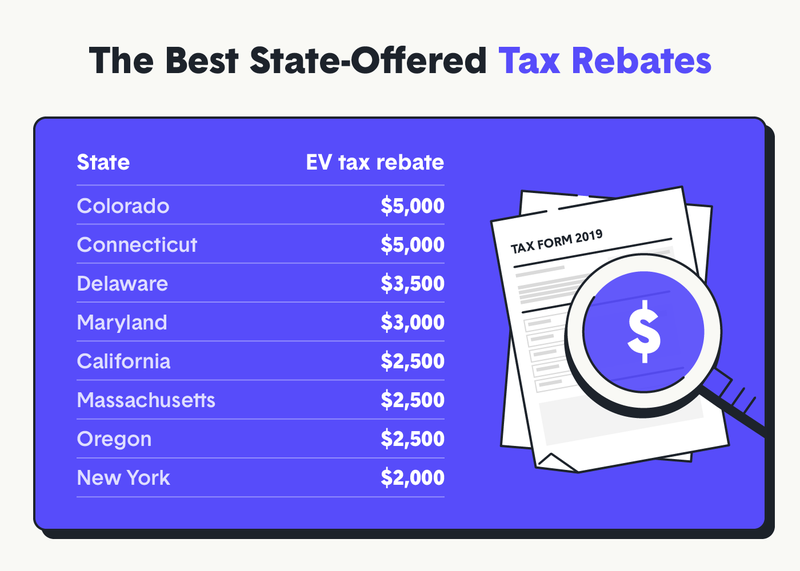

Going Green States with the Best Electric Vehicle Tax Incentives The, 1,50,000 under section 80eeb on the. Every year the irs posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle:

Source: www.theev-angelist.com

Source: www.theev-angelist.com

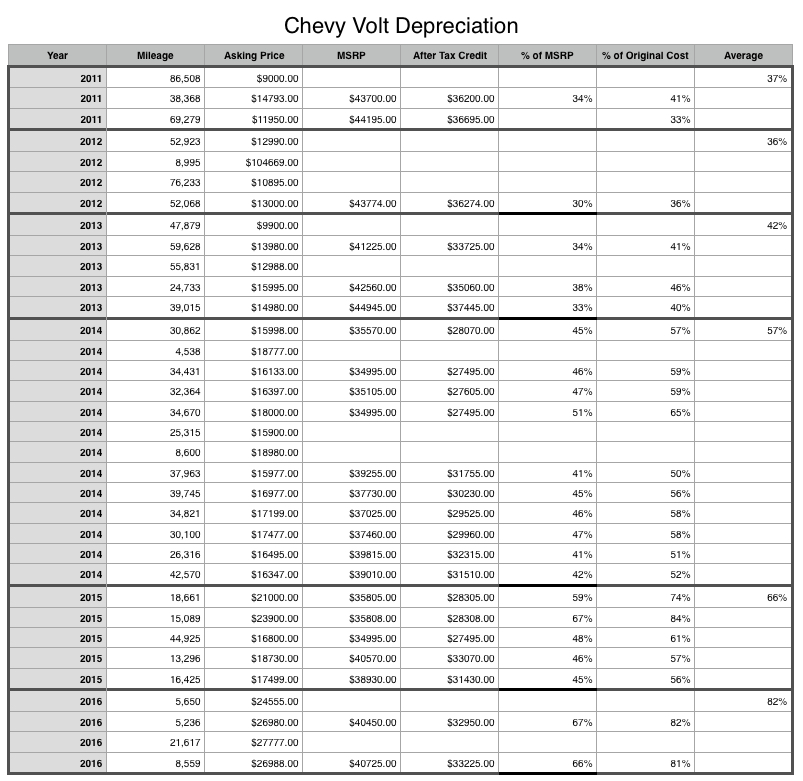

Plugin vehicle depreciation and the case for leasing The EVangelist, This guide includes rates for tangible and intangible assets,. Checking your browser before accessing incometaxindia.gov.in this process is automatic.

Source: www.teachoo.com

Source: www.teachoo.com

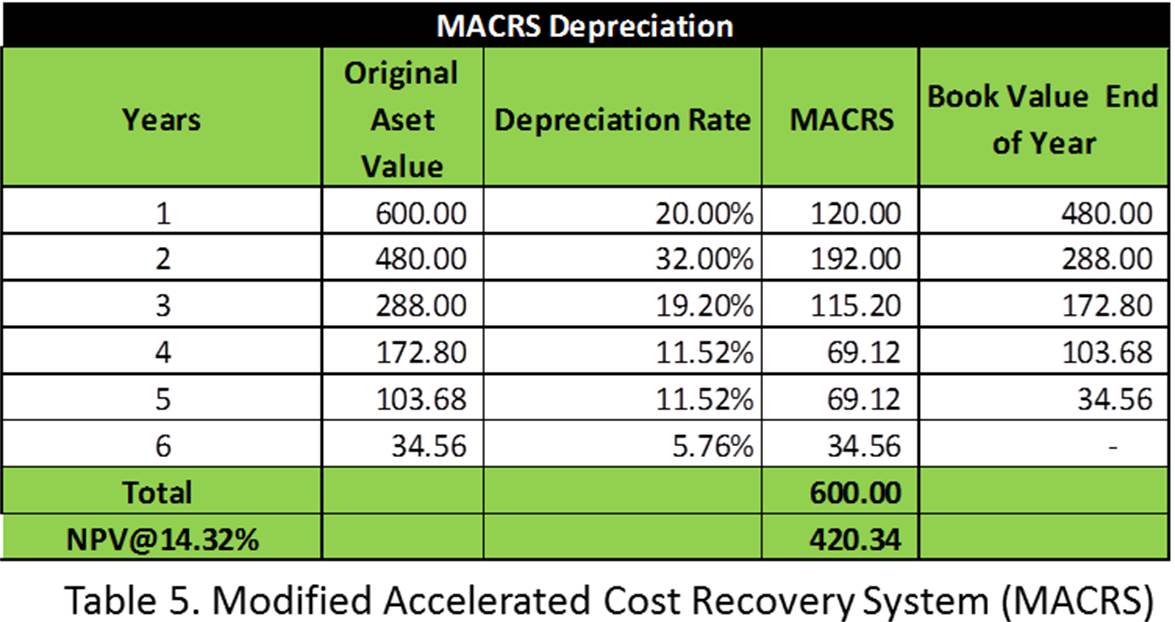

Depreciation as per Tax Assignment Depreciation Chart, The niti aayog recommendation will help commercial vehicle operators to ply more evs for greater tax benefits. Explore resources and inclusion amounts for electric cars with tax notes.

Source: haipernews.com

Source: haipernews.com

How To Calculate Depreciation Cost Of Car Haiper, You get a deduction of rs. Conversely, evs typically depreciate by.

Source: betterenergy.org

Source: betterenergy.org

Why Electric Vehicle Taxes Are the Wrong Strategy for Minnesota Great, The section defines the term electric vehicle as a vehicle powered. Do we need a logbook for an electric vehicle that is.

Section 80Eeb Of Income Tax Allows A Deduction On Interest Paid On A Loan Taken For The Purchase Of Evs.

The irs has provided limitations on tax depreciation deductions for electric vehicles.

New And Unused, Co2 Emissions Are 50G/Km Or Less (Or Car Is Electric) 100% First Year Allowances:

Checking your browser before accessing incometaxindia.gov.in this process is automatic.